Free Training Friday 1: The Cash Conversion Cycle

Out of everything I do, I love helping people learn and improve their skills and knowledge the most.

Selfishly, I’ve always loved helping people more than helping myself because it makes me feel good.

But talking to students and clients and being with them when they finally “get it” and when concepts, terminology, and techniques begin clicking into place, is absolutely amazing to be a part of.

Download A Free Copy of My Acclaimed Value Investing Education Book How To Value Invest By Clicking Here.

In this brand new series, we’re bringing those two things together and much more.

In this series, I’m going to release a new training video / session every Friday on the blog to help you improve your value investing skills and knowledge so you can reach your goals faster.

We’re also going to turn these sessions live at some point as well.

Once we get going here, we’re also going to do live training and Q&A sessions in this series.

Before we get to that, let’s start this series off right…

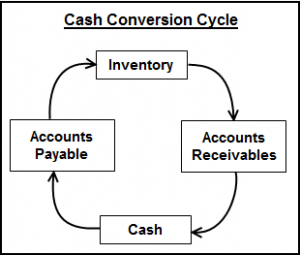

In the training session I did with a past client, we talk for 8.5 minutes about JUST the cash conversion cycle (CCC).

Why?

Because to me, this is one of the most important metrics I look at when evaluating any company, because the CCC can tell you the following things and more about a company:

- If the company is operating its business off of cash or not

- How strong the company’s balance sheet is

- How valuable the company’s balance sheet is

- How fast the company is selling inventory

- If they aren’t, will they have to write down inventory – thus decreasing the book value of the company and the strength of its balance sheet

- Is management doing a good job or not

- And much more…

I’m a huge believer in being as efficient as possible to help speed up not only the learning process for you, but also personally so I can spend less time on crap companies, so I can find great companies faster.

You can do this as well by learning the ins and outs of the CCC, because you can find out 5 to 10 important things – or at least where to research further – by just learning and looking at this one number.

I’m all about leveraging time, and gaining a huge legal advantage over others – if you learn the CCC you’ll do both of these things.

I’m working on an upcoming series in the Value Investing In Your Car Series on if I could only use three metrics to pick companies, which three would I pick – the CCC is one of them.

That’s how important this number is and almost no one talks about it.

That changes as discussed in the video below.

Until we get the live training / Q&A sessions up and running, let me know if you have any questions or comments or specific scenarios you want to know about when it comes to CCC, so I can make another video on them or even make you a video personally or do a FREE live training session just with you.

P.S. If you don’t want to miss any of these, or our other posts, make sure to sign up to our mailing list here for free.

By signing up for free, you’ll also instantly get five free gifts – including the Preliminary Analysis Checklist and Research Procedure Document that I’ll use every time I evaluate a company in this series.

P.P.S. If you want to see our other case study videos click here to go to our Value Investing Case Study playlist on YouTube.